michigan.gov property tax estimator

Worksheets 4 Recipients of FIPMDHHS 5 Renters Age 65 Estimator. Enter the date payment will be received by Treasury.

Wayland Union School Waylandunion Twitter

Welcome to the official Michigangov web site.

. Welcome to the NEW eServices portal. Enter the Taxable Value of your property and select the school district from the options. Estimate City Tax Late Payment Penalty and Interest Calculator.

Follow this link for information regarding the collection of. The Revenue Act includes provisions for charging penalty and interest if a taxpayer fails to pay a tax within the time specified. Office of the Auditor General.

For example if the citys millage rate is 10 mills property taxes on a home with a taxable value. Enter the amount of tax due. Skip Navigation Treasury Home Taxes Home Contact Treasury Forms MIgov Property Tax.

This site uses adaptive technology. The State Education Tax Act SET requires that property be assessed at 6 mills as part of summer property tax. 2022 Retirement Pension Benefits Chart.

Office of Inspector General. You can now access estimates on property taxes by local unit and school district using 2020 millage rates. This site uses adaptive technology.

Enter the date payment was due. 2021 Retirement Pension Estimator. Novitke Municipal Center 20025 Mack Plaza Grosse Pointe Woods MI 48236.

313 343-2785 Tax Questions. The median property tax in Michigan is 214500 per year for a home worth the median value of 13220000. Departmental Authors Employee Email.

Property Tax collapsed link. You can now calculate an estimate of your property taxes using the current tax rates. Pin On Income Resulting Property Tax Estimate Special Notes.

Reports and Legal Individual Income Tax New Developments for Tax Year 2021 Income Tax Self-Service New Developments for Tax Year 2021 Income Tax Self. Simply enter the SEV for future owners or the Taxable Value. 2022 Retirement Pension Estimator.

Interest is calculated by multiplying the unpaid tax. 41010 - Grand Rapids 41020 - Godwin 41050 - Caledonia 41110 - Forest Hills. Skip Navigation Treasury Home Taxes Home Contact Treasury Forms MIgov Property Tax.

313 343-2435 Water Billing. Worksheet 2 Tier 3 Michigan Standard Deduction Estimator. Welcome to the official Michigangov web site.

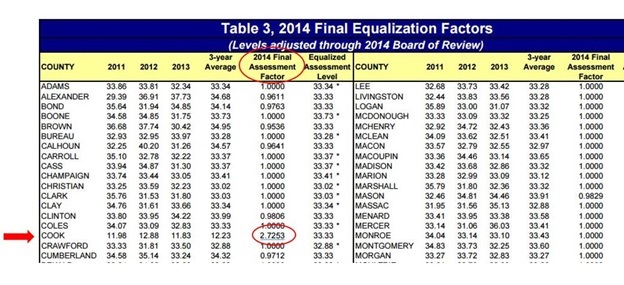

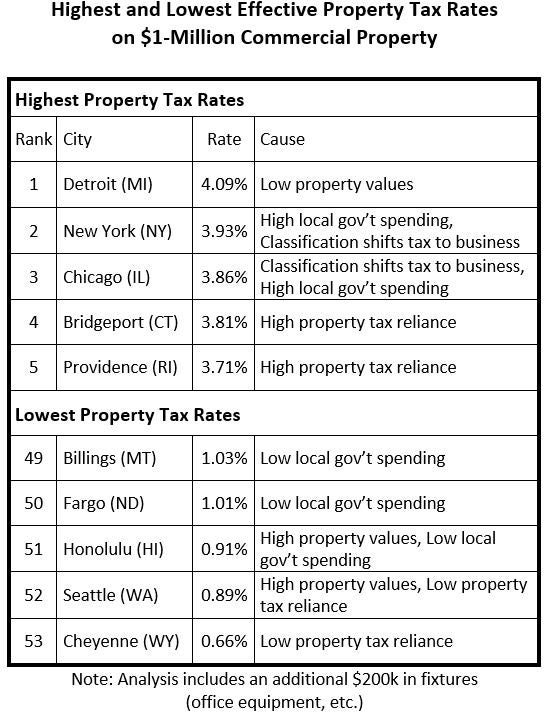

This Treasury portal offers one place for taxpayers to manage all their Individual Income Tax needs. Michigans Wayne County which contains the city of Detroit has not only the highest property tax rates in the state but also some of the highest taxes of any county in the US. Property owners can calculate their tax bill by multiplying their taxable value by the millage rate.

Use this estimator tool to determine your summer winter and yearly tax rates and amounts. Get the latest updates.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/19631901/Screen_Shot_2020_01_27_at_10.12.12_AM.png)

How To Read And Appeal Your Detroit Property Tax Assessment Curbed Detroit

How Do Tax Cut Plans Of Michigan Gov Gretchen Whitmer Republicans Compare Bridge Michigan

Michigan Department Of Treasury Taxes

Homeowners Property Exemption Hope City Of Detroit

Michigan Department Of Treasury Taxes

Township Tax Shelters Georgetown Public Policy Review

Michigan Property Taxes Estimator Jeremy Drobeck Amerifirst Home Mortgage

Gov Gretchen Whitmer Vetoes Gop Tax Cut Plan Again But Urges Negotiations Again Bridge Michigan

How Mi Property Taxes Are Calculated And Why Your Bills Are Rising

Calculate Your Community S Effective Property Tax Rate The Civic Federation

Property Tax Calculator Smartasset

Prorating Real Estate Taxes In Michigan

Lincoln Institute Releases Annual 50 State Property Tax Report Lincoln Institute Of Land Policy

Compare 2021 Millage Rates In Michigan Plus Fast Facts On Property Tax Trends Mlive Com

City Of Reno Property Tax City Of Reno

Treasurer Wexford County Michigan

Where Are Property Tax Rates Highest And Lowest In Michigan Mlive Com