sacramento county tax rate 2021

The December 2020 total local sales tax rate was also 7750. 775 Is this data incorrect The Sacramento County California sales tax is 775 consisting of 600 California state sales tax and 175 Sacramento County local sales.

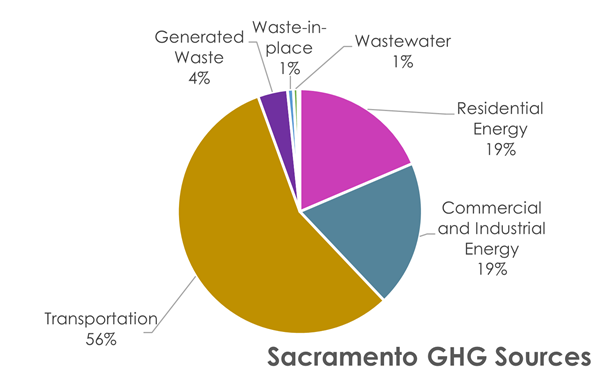

Climate And Transportation City Of Sacramento

The California sales tax rate is currently.

. This is the total of state and county sales tax rates. The Assessors office electronically maintains its own parcel maps for all property within Sacramento County. The minimum combined 2022 sales tax rate for Sacramento California is.

The sacramento sales tax rate is. The current total local sales tax rate in Sacramento CA is 8750. City Rate County Feather Falls 7250 Butte Fellows 7250 Kern Felton 9000 Santa.

Tax Rate Areas Sacramento County 2021 A tax rate area TRA is a geographic area within the jurisdiction of a unique combination of cities schools and revenue districts that. Emerald Hills Redwood City 9875. 1919 Thurmond Mall Columbia SC 29201.

2020-2021 compilation of tax rates by code area code area 03-035 code area 03-036 code area 03-037 county wide 1 10000 county wide 1 10000 county wide 1 10000 los rios coll gob 00223 los rios coll gob 00223 los rios coll gob 00223 sacto unified. The current total local sales tax rate in Sacramento County CA is 7750. The December 2020 total local sales tax rate was also 8750.

July 2 2021 - Sacramento County Assessor Christina Wynn announced today that the annual assessment roll topped 199 billion a 519 increase over. Under California law the government of Sacramento public schools and thousands of other special purpose districts are given authority to appraise housing market value fix tax rates and. Box 8207 Columbia SC 29202-8207.

How much is county transfer tax in Sacramento County. Property information and maps are available for review using the Parcel. 55 for each 500 or fractional part thereof of the.

Roseville California Sales Tax Rate 2021 The 775 sales tax rate in Roseville consists of 6 California state sales tax 025 Placer County sales tax 05 Roseville tax and. How much is the documentary transfer tax. 075 lower than the maximum sales tax in CA.

The 875 sales tax rate in Sacramento consists of 6 California state sales tax 025 Sacramento County sales tax 1 Sacramento tax and. A county-wide sales tax rate of 025 is applicable to localities in Sacramento County in addition to the 6 California sales tax. Effective 1012021 through 12312021.

California City and County Sales and Use Tax Rates. The California state sales tax rate is currently. The minimum combined 2022 sales tax rate for Sacramento County California is.

The 875 sales tax rate in Sacramento consists of 6 California state sales tax 025 Sacramento County sales tax 1 Sacramento tax and 15 Special tax. Some cities and local governments in Sacramento County collect additional local sales taxes which can be as high. This is the total of state and county sales tax rates.

This does not include personal unsecured property tax bills issued for boats business equipment aircraft etc. View the E-Prop-Tax page for more information. The minimum combined 2022 sales tax rate for Sacramento County California is.

Sacramento property tax rate 2021. Sacramento County collects on average 068 of a propertys. The median property tax in Sacramento County California is 2204 per year for a home worth the median value of 324200.

803-252-7255 800-922-6081 Fax 803-252-0379. How much is the. T he tax rate is.

Sacramento-county Property Tax Records - Sacramento-county Property Taxes Ca. This is the total of state county and city sales tax rates. The Sacramento County Sales Tax is 025.

California Sales Tax Rate Changes In July 2022

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

Here Is Your The Ultimate Guide To Real Estate Taxes

California Taxpayers Association California Tax Facts

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

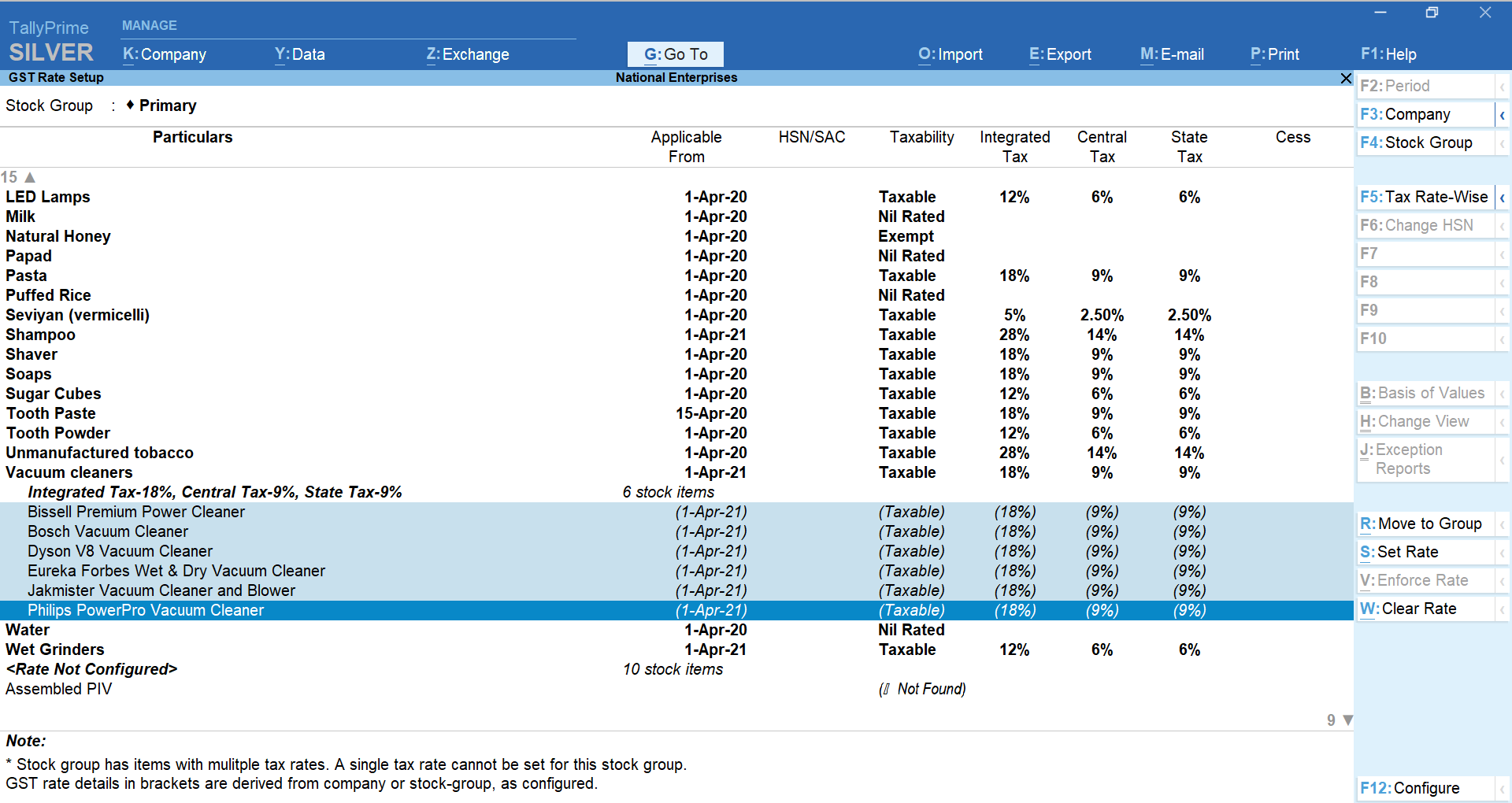

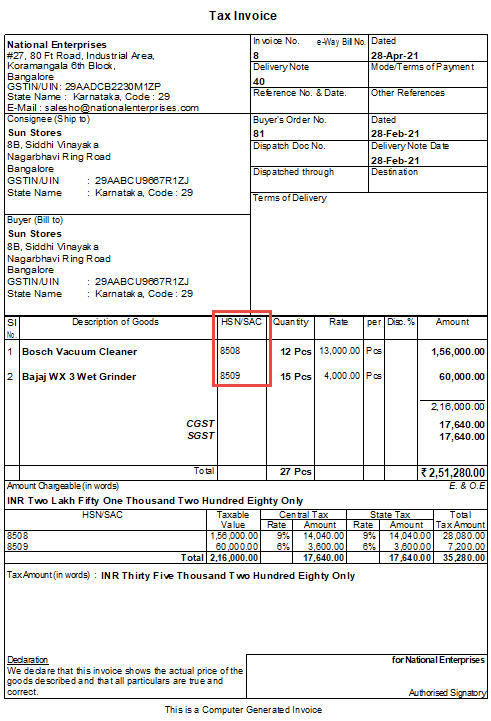

How To Manage Hsn Codes Sac And Tax Rates In Tallyprime Tallyhelp

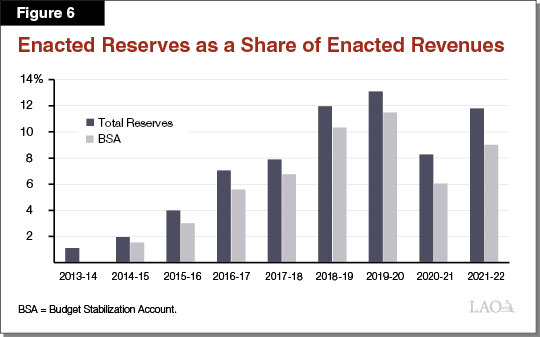

The 2021 22 Spending Plan Other Provisions

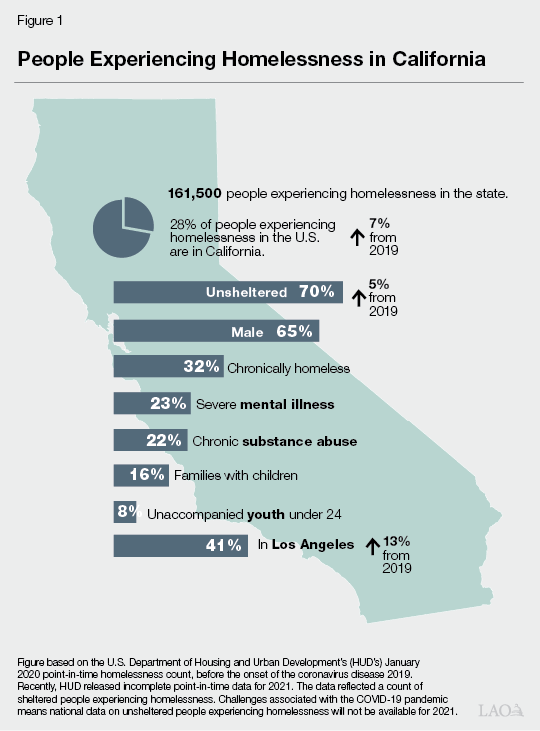

Sacramento S Solutions And Pending Are Growing Homeless Population California Globe

Prop 19 And Property Taxes In California Marc Lyman

The 2022 23 Budget The Governor S Homelessness Plan

How To Manage Hsn Codes Sac And Tax Rates In Tallyprime Tallyhelp

California Taxpayers Association California Tax Facts

Cities With The Most Female Six Figure Earners 2021 Edition

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

How To Manage Hsn Codes Sac And Tax Rates In Tallyprime Tallyhelp